US hedge Funds remain untrimmed

Hedge funds are among the most profitable clients for firms like Goldman Sachs Group , Bear Stearns , Morgan Stanley, UBS , JPMorgan Chase and Lehman Brothers . Many of these same massive Wall Street firms have large in-house hedge funds of their own.It is an "industry" that is said to handle an eye popping $1.2 trillion of assets. One that affects every pensioner, stockholder and overeas investors. Remember Goldman Sachs Group Inc. and Morgan Stanley led Wall Street in handing out a record $21.5 billion in 2005 bonuses, according to New York State Comptroller Alan Hevesi.

The SEC counts more than 8,800 such funds. The industry controls some 30% of the NYSE daily volume in stock trading alone.

Monday is the deadline for an appeal against the decision in June by the U.S. Court of Appeals, District of Columbia Circuit, in a lawsuit brought by a New York hedge fund, Opportunity Partners,that tossed out the agency's controversial new rule requiring many hedge funds to register and submit to exams with a unanimous decision on multiple grounds.

Chairman of the SEC said last week at a Senate Banking Committee hearing he still believed hedge funds needed more oversight, but didn't suggest Congress rewrite statutes to make that possible. He said he didn't want to put restrictions on how funds operate, but he did say he wanted to make it harder for "unsophisticated" retail investors to put money into them.

So the scam for keeping the market afloat , the dollar alive, carries on for a little while longer - and commodities drive higher as the hedge funds make bigger and bigger bets on futures - who will blink first? Meanwhile - a good indicator is the sales of properties (hit by high mortgage rates) in the Hamptons which are well down - 1,727 homes sold 1st half '6 compared with 2,106 last year according to Suffolk Research Service Inc., a property records company in Southampton. NY. ( A sort of Hampton index ?)Even so the rich are still buying Edgar Bronfman Jr., CEO the Warner Music Group, and once married to someone famous, paid US$31 Mn for a pad in January.

If you want the next part of the story go and read up about B. Alfred Lee Loomis and bailing out at the top of Consolidated funds in '28.

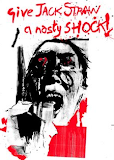

We were to post an untrimmed bush - but we haven't.

No comments:

Post a Comment