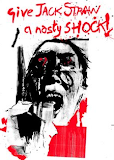

Drax - sunset on the UK energy industry

Drax Power Limited owns and operates Drax Power Station, the largest, cleanest and most efficient coal-fired power station in the UK.

Drax Power Limited owns and operates Drax Power Station, the largest, cleanest and most efficient coal-fired power station in the UK.

The generating units are fitted with flue gas desulphurisation (FGD) equipment removing 90% of SO2 from emissions, and work is underway to reduce still further emissions of oxides of nitrogen (NOX).

The plant is experimenting with bio fuels (willow chips) and petcoke which is a recovery from oil refining.

By-products of the coal combustion and FGD processes are recycled through their further use in the construction industry.The plant output 4,000 megawatts, 7% of the UK's electricity needs.

Drax Group Limited

…is Incorporated in the Cayman Islands Co No WK-129356

Registered Office

Walkers SPV Limited

Walker House

PO Box 908GT

Mary Street

George Town

Grand Cayman

Cayman Islands

British West Indies

Today the company announced someone wanted to buy them…and the plant which is a core component of the UK energy supply. …

Drax Group Limited ("Drax") today announces that it received on 10 October 2005 a new approach from a consortium regarding a possible cash offer for Drax. The proposal is subject to a number of conditions, including due diligence and financing, and is an alternative to the listing. Drax is seeking further clarification on the initial approach...

It was only a few weeks ago that someone else wanted to buy them ..

The Board of Drax Group Limited ("Drax" or "the Company") announces that it received on 12 September an indicative approach from a consortium comprising Constellation Energy Group, Inc and Perry Capital LLC regarding a possible cash offer for Drax representing an enterprise value of £1.9 billion. The proposal is subject to a number of conditions, including due diligence and financing...

But the Directors turned the offer down.

So how is it that a shadowy group of investors, located in the Cayman Islands have become a much wanted asset ?

Briefly, In 1990, the electricity industry of England and Wales was privatised under the Electricity Act 1989. Three generating companies and 12 regional electricity companies were created. As a result of privatisation, Drax Power Station came under the ownership of National Power, one of the newly formed generating companies.

Due to changes in the structure of the market , needs for cash, a change in strategy in 1999 Drax Power Station was acquired by the US-based AES Corporation (A Delaware based outfit) for £1.87 billion. Of course it wasn’t their money, they borrowed it and so they ended up with a raft of creditors, which when things went sour they couldn’t pay.

So they “restructured” the debt , which meant the “D” level guys were toasted but the “A” level creditors , some of whom like mining giant BHP Billiton were supplying the plant with coal.

Following a series of standstill agreements with its creditors, the AES Corporation and Drax parted company in August 2003. Just months later in December 2003, creditors overwhelmingly supported a financial restructuring scheme that put Drax into the ownership of a number of financial institutions.

On December 22, 2003, The Debevoise & Plimpton partnership (fancy US corporate lawyers) could announce, after drawing monster fees, that Drax Power, Europe’s largest coal-fired power station, had successfully restructured its ₤1.3 billion senior secured debt. Debevoise & Plimpton LLP represented Drax Power in this transaction.(Once owned by the British Public)

On December 22, 2003, The Debevoise & Plimpton partnership (fancy US corporate lawyers) could announce, after drawing monster fees, that Drax Power, Europe’s largest coal-fired power station, had successfully restructured its ₤1.3 billion senior secured debt. Debevoise & Plimpton LLP represented Drax Power in this transaction.(Once owned by the British Public)The successful restructuring puts Drax, which supplies 8-10% of Britain’s power, in a strong financial position going forward. The refinancing involved concurrent schemes of arrangement in England, Jersey and the Cayman Islands, and a Section 304 bankruptcy court proceeding in the United States.

The BBC reported that there were four bids considered for re-structuring which took the form of complex offers to buy out portions of the plant's debt.

BHP Billiton's offer, worth an estimated £95m, would see holders of Drax's A-2 debt get 70p in the pound. International Power another energy company offered 65p in the pound for A-2 debt and 55p in the pound for B debt. Goldman Sachs the bankers were offering 64p in the pound for A-2 debt and 50p in the pound for B debt.

Money market men said that the deal was finally agreed at what represented approximately 70p per pound of debt. In brief they bought £1.34 Bn of assets at a discount of 30% = £ 938 Mn (give or take a few bob).

Since taking over ownership effectively from Jan 1st 2004, the company has seen the price of wholesale electricity climb from £24 per Megawatt Hour to £48 MWH, which is the good news, the bad news is the price of coal has gone from under £10 a ton to £25 a ton. However the owners have seen for example Nett profits for the first 6 months of 2005 at £227 Mn and interest has been paid at the rate of £160Mn per year (mainly to the owners) who bought that debt. (Caveat - the £227Mn profit includes one off payments from TXU Europe whose bankruptcy caused AES to founder – but this was factored into the buying price because it was problematic at the time and required an Act of Parliament to change the rules so they could get the money).

So not exactly a wild cash cow, but has been a nice little earner that Debevoise & Plimpton partnership and (Morgan Stanley hovering in the background) put together…and now someone else wants to have a share of the action.

So that’s OK for the UK ?

Well up to a point Lord Copper.

Drax has contracts for coal with UK Coal, (the rump of the NCB after Maggie destroyed it) who are the biggest UK (in fact only) coal miner. Figures for the year ended December 2004 showed pre-tax losses deepened to £51.6 million, from a loss of £1.2m in 2003. Deep-mine output dropped from 14.8 MN tonnes in 2003 to to 12.0 million while surface mine output was down from 3.1 Mn tonnes to 2 MN.

When posting half-year losses of £30.6m, UK Coal warned attempts to support further development at Rossington had failed and that the mine would be mothballed – the same fate as Harworth mine once current extraction is completed.

Their shares up from a low of the mid 40’s pence in early 2003 have moved sideways at 140/145 p for nearly 12 months, bn 3200Mn of that is surface property and landholdings, the last asset of the old NCB.

Now Tom Farmer famous for his Kwit Fit chain is said to want to buy the property portfolio and there is talk of an offer of 180p – 200p per share. Farmer is working with Alchemy Partners who lost out on MG and also the bachelor Lord Buccleuch, the only landownder in Scotland whose estates are so large you cannot ride across them on a dhorse in a day.

The shares haven’t moved, principally because nobody wants to run mines that lose £36Mn in 6 months.

Which is why the figures for coal imports into the UK make such interesting reading. In 2004, Coal imports increased by 20 % - a new record level. 72% of the United Kingdom’s imports of coal came from just three countries: South Africa, Australia and Russia. A further one fifth of coal imports came from three additional countries, Colombia (steam coal), USA (mainly coking coal) and Indonesia (steam coal).

Steam coal imports came mainly from South Africa (34 %), Russia (33%) and Colombia (12 %). Imports of steam coal from the USA were substantially higher in 2004 than 2003, accounting for 2.4 per cent of the total in 2004 compared with less than 0.1 per cent of the total in 2003. Imports of steam coal from South Africa in 2004 were more than double the volume imported in 2000. All but a very small fraction of UK coking coal imports came from Australia (65 %), the USA (21 %) and Canada (11 %).

So this is where our with the wonderful far sighted New Labour White Paper Energy policy.

An irreplaceable national source of electricity, owned by a bunch of financiers operating out of a nameplate in the Cayman Islands.

A company being stalked by the funny money men.who have no interest in UK energy independence.

This company relies upon a company mining coal which is evident cannot carry on mining / trading, (even if Tom Farmer rides in and picks up their property assets)

....... Unless of course the Government see that they can add some more subsidies to the pot – and there have been plenty in the last few years, disguised in a variety of ways.

Suddenly nuclear power stations look like a good idea.(if not the only)

Recent blogs on same topic here

No comments:

Post a Comment